We all love online shopping and in the United Kingdom it is reported that 87 percent of all retail purchases (grocery shopping not included) are conducted on the Internet. We all know how easy it is to visit a website, make a purchase and then wait for a courier to deliver the goods in one to two days. It’s simple, as we purchase more goods online, the more parcels are being delivered to homes or collection points, resulting in more couriers.

Self-employed workers are used across the country by delivery companies, largely serving the booming internet shopping market. They include home delivery specialist Hermes who has over 15,000 couriers, Amazon, parcels giants DPD, Parcelforce and thousands of independents.

At Credo Asset Finance we can help self employed couriers with the purchase of their vehicles to make the final mile delivery. We have finance solutions available to take care of unlimited mileage, low or no deposits and competitive monthly payments. We also lend on our own book, so if a client has been previously rejected by the banks, because of credit scores, we can make our own decisions and potentially still lend.

In addition to vehicles there are other assets which can be financed within the courier market, including computer and communications equipment and warehouse fixtures and equipment such as racking, forklifts and pallet trucks.

We can help finance in many different areas of the courier market:

- A lifestyle courier who delivers around 70 parcels a day from the back of their car, many of the Hermes couriers are under this model.

- A van driver who drives to their collection depot and deliver up to 200 parcels per day.

- A sameday courier who travels from A-Z with urgent documents and parcels and may operate a small van or a motorbike.

- A courier team, where an individual has several couriers working in an area. As an example, one person may operate a small fleet of 10 vans and has workers to complete the deliveries.

- A franchisee where they own a dedicated area and have a mixture of employed and self-employed couriers.

- An owner business where Credo can help with the funding of additional items such as computer equipment, communications equipment and warehouse equipment.

Asset Finance solutions let you spread the costs of purchases. They include a range of funding types:

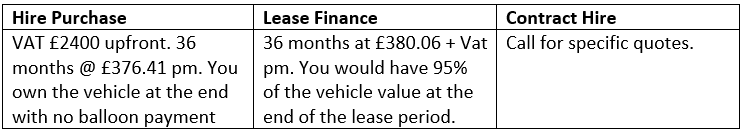

Hire Purchase

Hire Purchase, also known as lease purchase, is a finance solution that gives you ownership of the asset but without the upfront costs. It’s the traditional form of asset finance. You spread your payment into affordable monthly repayments with an option to buy the asset at the end of the contract.

Lease Finance

Leasing gives you flexibility. You are renting the asset, Vat on the purchase price is spread across the agreement meaning a cashflow friendly option is offered. At the end of the agreement you can upgrade (taking equity forward to the new deal) or pay a small annual rental to retain use of the asset.

Contract Hire

Contract Hire is a form of extended rental agreement which offers low deposits and can also include a maintenance package to care for your new vehicle. Because of return condition clauses and the mileages generally untaken by couriers, this is not the best option for your needs.

Example for a New Citroen Berlingo:

Finance based on £12,000 ex VAT, no deposit and unlimited mileage. These quotes are for business users only. Payments are monthly in advance. These quotes are subject to final underwriting, a guarantor may be required

The future for home delivery is aiming to be much greener, with drones and droids being developed to make deliveries, more electric vehicles becoming the norm and Amazon has even patented flying distribution centres that can be taken wherever they are needed!

To receive a finance quote please fill out our simple form or give one of our advisers a call today on 01603 381955 for more information.

An indemnity may be required in certain circumstances. All finance is subject to applicant status and is available for over 18’s only. Any specific quote requirements available on request. For your protection and to assist with staff training, telephone calls to Credo Asset Finance Ltd may be recorded.

Credo Asset Finance Ltd is authorised and regulated by the Financial Conduct Authority.